Input Tax Credit is a topic near to the heart of every taxpayer.

A taxpayer is always cautious about the changing rules to claim the ITC authentically.

Truth be told, Input Tax Credit is a complicated affair if the taxpayer is non-compliant at any one stage of the process to claim Input Tax Credit.

It is important to know the rules and staying compliant with them, in any case, is even more important.

In this short article, we will be discussing the ‘Common Credit’ concept & the rules corresponding to it.

Common Credit in GST with Example

What is Common Credit?

A business gets inward supplies of services or goods or both, from its Supplier.

It’s at the discretion of the business to use these goods for business purposes or personal purposes.

The total tax credit available on such mixed purchases is termed as ‘Proportionate Credit’ or ‘Common Credit’ under GST.

A taxpayer is NOT allowed to avail of the Input Tax Credit on the goods consumed for personal or non-business use.

Thus, while filing the outward tax liability, the business should carefully identify such goods and should NOT claim any Input Tax Credit for such goods.

An Example will be great!!!

Suppose a business ‘GY Electronics’, purchases 20 Washing Machines from its Supplier.

Each Washing Machine costs ₹ 25,000.

So, cost of 20 W.M = 25,000 x 20 = ₹ 5,00,000

Total GST paid (28%) = ₹ 1,40,000

GST paid on each W.M = ₹ 7,000

Also Read- GST Registration: All You Need to Know

Now, out of these 20 machines, 2 Washing Machines were gifted to his family members.

So this gifting thing is a ‘Personal’ or ‘Non-Business’ use.

The GST paid in all at the time of Purchase = ₹ 1,40,000

This amount is called the ’Common Credit’.

Now, how much ITC can GY Electronics claim while settling his outward tax liability?

The ITC CAN NOT be claimed on the GST paid for the 2 machines used for Personal Consumption.

Thus, GY Electronics can claim Input Tax Credit on the GST paid on the rest 18 Washing Machines (18 x 7000 = ₹ 1,26,000).

How Do I Utilize this Common Credit?

A business has to classify its goods in a proper category to avail 100% Input Tax Credit under GST.

There are two basic thumb-rules, a business has to consider while legitimately utilizing the common credit:

1. ITC on goods used for ’Business Purpose only’.

2. ITC on sale of taxable goods or services only.

Must Read- e-Invoice Generation 2021 Update & Benefits of E-Invoice Reconciliation

The other meaning of the above-given statements can also be interpreted as follows as shown in the table:

| Purchasing | Used For | Can I Claim ITC on this? |

|---|---|---|

| Goods or Services | Business purpose | Yes |

| Non-business purpose | No | |

| Both | Claim only eligible ITC (which involves business transaction) | |

| Goods or Service | Selling taxable goods | Yes |

| Selling goods or service exempted from paying GST | No | |

| Selling both types of goods or services | Claim only eligible ITC (which involves the sale of taxable goods or service) |

Calculating Common Credit under GST

Let’s talk about the numbers now!

What better than an example to understand a concept which involves numbers?

Let us assume, ‘Amulbhai Milk Processing Centre’.

It’s a Milk Processing Centre; it collects milk from the small farmers in the town and processes it & supplies it to large cities.

Milk is an exempted good.

Alongside milk processing, this plant also manufactures & supplies ‘aerated water cans’ (soda). This comes under the GST slab of 28%.

Following is the data of this business of June 2021:

| Parameter | Value (Rs.) |

|---|---|

| Total Input Tax Credit available as per GSTR 2B | 1,50,000 |

| Total sale of non-taxable products (milk) | 3,50,000 |

| Total sale of taxable products (aerated water cans) | 2,00,000 |

| ITC value on taxable products | 56,000 |

| Input Tax Credit on the input of services like a labour of producing GST exempted goods | 19,000 |

| Input Tax for purely personal consumption (Amulbhai painting his house) | 10,000 |

| Services on whom availing ITC is not eligible (travelling or business purpose) | 11,000 |

Now we have a complete report for a month about the types of goods & services sold or purchased by the Amulbhai Milk Processing business.

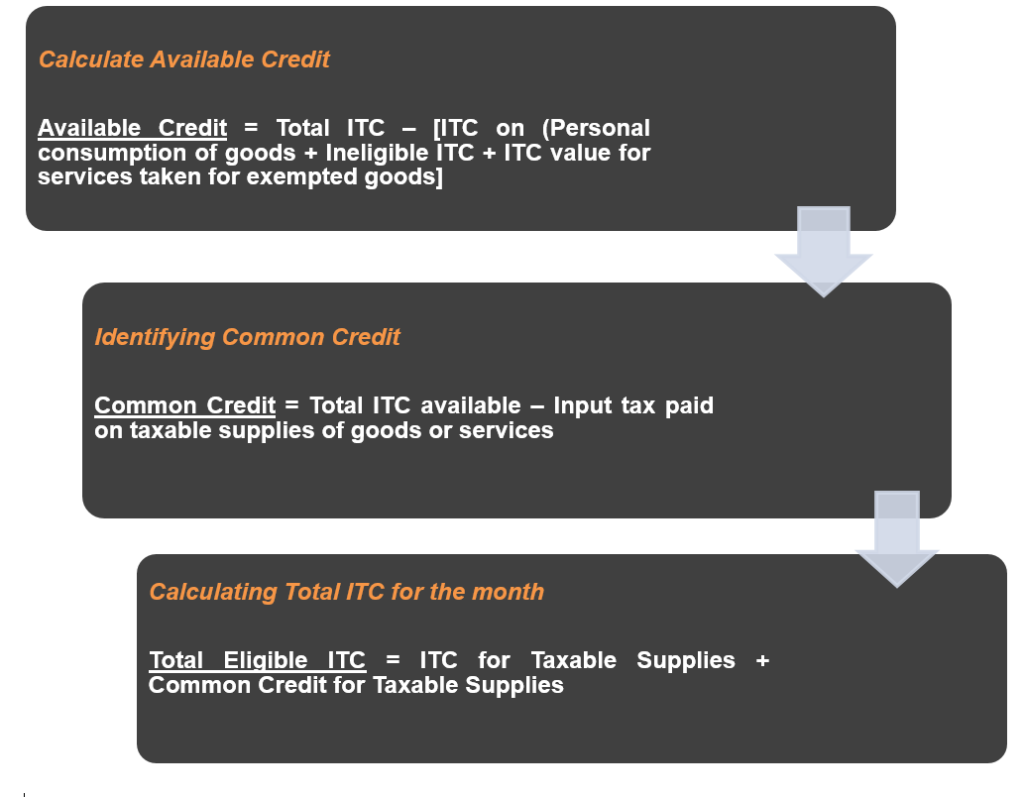

Step1: Finding eligible Input Tax Credit

We can calculate the eligible credit for this business as follows:

Available Credit = Total ITC – [ITC on (Personal consumption of goods + Ineligible ITC + ITC value for services taken for exempted goods]

Available Credit = 1,50,000 – [10,000 + 11,000 + 19,000 ] = ₹ 1,10,000

This is the ‘Total Eligible ITC’.

Step 2: Identifying Common Credit

Common Credit = Total ITC available – Input tax paid on taxable supplies of goods or services

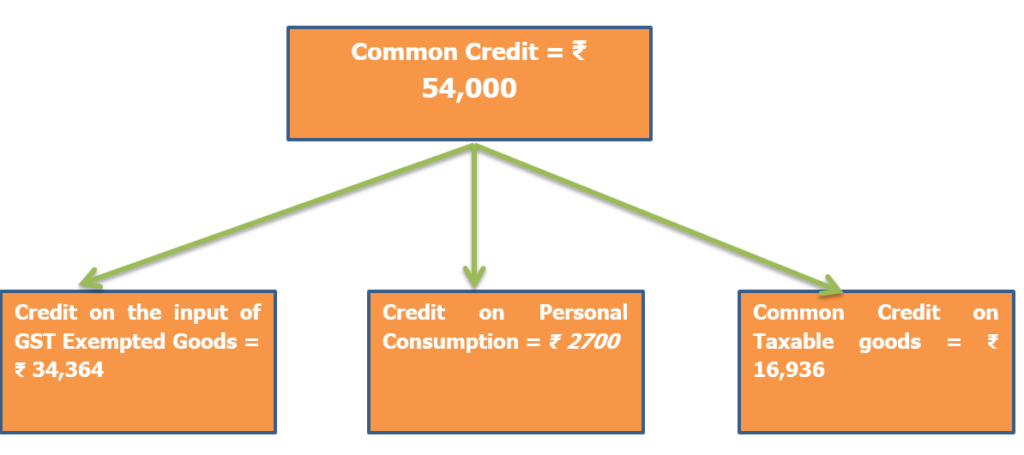

Common Credit in example = ₹ 1,10,000 – ₹ 56,000 = ₹ 54,000

This amount is the collective sum to be shared between

- GST exempted goods supplies

- Personal consumption &

- Taxable supplies.

1. For GST Exempted Goods

D1= Exempted Turnover/Total Turnover*Common Credit.

In our case it will be- 3,50,000/5,50,000*54000= Rs. 34,364 (D1)

So according to our example, ₹ 34,364 is considered to be the ITC corresponding to the ‘Exempted Goods’ i.e. Milk.

2. For Personal Consumption

The formula calculates the amount by assuming 5% of inputs are used for personal purposes.

i.e. 5 % of Common Credit

By our example this becomes,

5% of 54,000

i.e. D2 = Rs. 2700

This should be reversed by the business in its GSTR-2 returns.

3. For Taxable Supplies

The formula to calculate this goes as shown below:

D3 = Common Credit – [ITC on the input of exempted supplies + ITC on personal consumption of goods]

D3 = 54,000 – [34,364 + 2700] = Rs. 16,936

D3 = Rs. 16,936

Now, we can calculate Total Eligible ITC available for this business for the current month can be calculated as:

Total Eligible ITC = ITC for Taxable Supplies + Common Credit for Taxable Supplies

ITC Available = 56,000 + 16,936 = Rs. 72,936.

To sum the complete process up, we can summarize it in simple words:

The basic thing we understand from the term ‘Common Credit’ is that it is trifurcated into 3 parts.

Finally,

To calculate Total Eligible ITC

Impacts of Common Credit on Annual Returns

Businesses must adhere to the rules of the Common Credit under Input Tax Credit.

In the GSTR-2 format, a business has to furnish the details of the total ITC claimed during the financial year.

At this point, it is very important for the business that there remains NO difference between the ITC claimed during the year & the ITC of the annual return.

Failure in doing so may attract a penalty for claiming ineligible ITC and also may result in the blocking of your working capital.

To avoid all this mess, the businesses should have robust and GST software in place to allow you to manage all your Input Tax Credit details & also help reduce your manual efforts of reconciling your returns to claim maximum Input Tax Credit.

To Conclude

Common Credit’ is sure a tricky thing to understand, but the businesses must understand it well & that is what this article is intended at.

The best option to avoid all the further complications is to have an automated software infrastructure in place.

GSTHero is one such automated software that will help you in ITC Reconciliation and help you in claiming about 100% eligible Input Tax Credit.

With GSTHero’s ITC Reconciliation, you can:

- Eliminate errors

- Identify defaulters

- Free up capital

GSTHero is a government-appointed GST Suvidha Provider (GSP), thus remains 100% compliant with the ever-changing rules of the GST.

Stay informed, stay ahead!

Until the next time…

Join our Social Community

Disclaimer: The information contained in the above article are solely for informational purpose after exercising due care. However, it does not constitute professional advice or a formal recommendation. The author does not own any responsibility for any loss or damage caused to any person, directly or indirectly, for any action taken on the basis of the above article.