The process of filing ITR is not just limited to submitting your return, but it involves some more steps to get your Income Tax Return ready. The process of this is as follows-

Step 1- E- File Your Income Tax Return.

Step 2- Verify your Income Tax Return.

Step 3- Income Tax Department process your return.

If all the above steps have been completed then it is assumed that the Income Tax Department has accepted your return.

In this post, we will discuss step 2 i.e. Verification of Income tax Return (How to Verify ITR).

How to Verify ITR- Know the method for verification of Income Tax Return

After filing of Income Tax Return it is mandatory to verify your Income Tax Return (ITR), if you do not do so in a given time, then your return can be marked as invalid by the department.

For verification of ITR, there are two methods one is offline verification and the second is online verification.

Also Read- Know the Benefits of Filing ITR- File your ITR to get these benefits

Verification of Income Tax Return- offline method

If you are going to verify your return through the offline method then there is only one option available i.e. through signature.

How to Verify ITR offline- This option is available only to Individual and HUF, this includes the following steps-

Step 1- Download the Filed ITR V from the portal.

Step 2- Take a print out of downloaded ITR V.

Step 3- Signed the ITR V (as instructed by the department).

Step 4- Send the original copy of signed ITR V to CPC, Bangalore.

Note 1- The ITR V needs to be sent within a period of 120 days from the date of filing.

Note 2- Once the ITR V received by CPC, the same will be checked and verified.

Must Read- Difference between Gross Total Income and Total Income under Income Tax Act

How to e verify ITR- Online Method

The online method of ITR verification is not a big task and the same also needs to be completed within a period of 120 days, from the date of filing.

For e verify your Income Tax Return, there are a total of 5 methods, which are as follow-

| Aadhar OTP, |

| Net Banking of Authorized Bank, |

| E verification of ITR through Demat Account, |

| EVC verification with bank a/c number, through the Income Tax Portal, |

| via Bank ATM. |

All the above methods will work only when you had linked your Aadhar card to your PAN no., had bank registered with the department, had pre-validated your bank a/c, and had Demat registered with the department respectively.

Also Read- What is the Interest and Penalty for late filing of ITR

Verification of ITR using Aadhar OTP

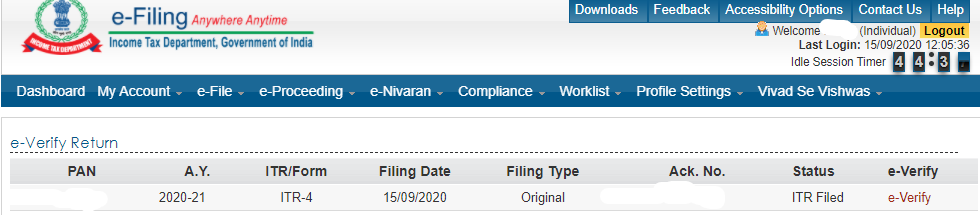

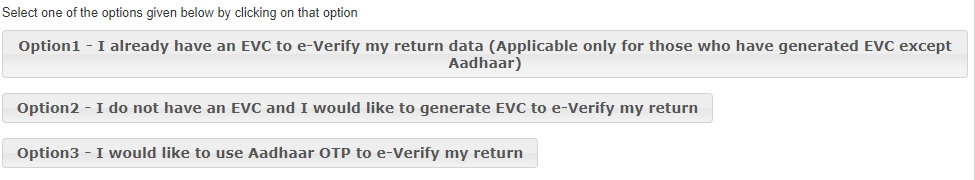

For this, you need to first link your Aadhar card with your PAN Card (one time process), after that under the “e-verify” option you need to select “I would like to use Aadhar OTP to e-verify my return” (Option 3 in the below-mentioned image). One time password will be sent to your registered mobile no. with Aadhar card which will be valid for 10 minutes.

e verify your ITR with Net Banking

Verification of ITR using net banking is available for selected banks.

How to Verify ITR using net banking- For this purpose, you need to follow the below steps.

Step 1- Login to Net Banking A/c.

Step 2- Find the e-filing tab and click on the “e-Filing” link.

Step 3- You will be redirected to the e-Filing Portal.

Step 4– Click on the “My Account” Tab and Select “e-verify” from the drop-down.

Step 5- Select the “e-verify” link just after the respective assessment year.

Now ITR Verification Completed Successfully.

Also Read- Types of ITR Forms- which ITR form should I filed?

e verify your ITR through Demat Account

For this purpose, you need to pre-validate your Demat account with the portal. After validating EVC will be sent to the registered mobile no. and verification will be successfully complete.

How to Verify ITR using Demat account- For this purpose, you need to follow the below steps.

Step 1- Go to the e-filing portal.

Step 2- Pre validate your Demat Account Number (if not validated yet)

Step 3- Click on the “My Account” Tab and Select “e-verify” from the drop-down.

Step 4- Select the “e-verify” link just after the respective assessment year.

Step 5- Select Generate EVC through Demat Account Number.

Step 6- Use this EVC to E-verify return.

Now ITR Verification Completed Successfully.

ITR verification through Bank A/c Number

For this purpose, you need to pre-validate your bank account with the portal. After validating EVC will be sent to the registered mobile no. with the bank.

How to Verify ITR using Bank A/c Number- For this purpose, you need to follow the below steps.

Step 1- Go to e-filing portal.

Step 2- Pre validate your Bank Account Number (if not validated yet)

Step 3- Click on the “My Account” Tab and Select “e-verify” from the drop-down.

Step 4- Select the “e-verify” link just after the respective assessment year.

Step 5- Select Generate EVC through Bank Account Number.

Step 6- Use this EVC to E-verify return.

Now ITR Verification Completed Successfully.

How to Verify ITR using ATM

Follow the below steps to verify your Income Tax Return (ITR)

Step 1- Swipe your debit card at the bank ATM.

Step 2- Select the option of “Generate PIN for e-filing”.

Step 3- You will receive the EVC on your registered mobile no.

Step 4- Now login to Income Tax Portal and Select the option “e-verify using ATM”.

Step 5- Enter the EVC to verify your return.

Now ITR Verification Completed Successfully.

Also Read- What is the due date of the Income Tax Return Filing?

Frequently Asked Questions- FAQs

-

How do I verify my ITR?

For e verify your Income Tax Return, there are a total of 5 methods, which are as follow-

Aadhar OTP,

Net Banking of Authorized Bank,

E verification of ITR through Demat Account,

EVC verification with bank a/c number, through the Income Tax Portal,

via Bank ATM. -

What is EVC verification?

ITR verification through Bank A/c Number, for this purpose, you need to pre-validate your bank account with the portal. After validating EVC will be sent to the registered mobile no. with the bank.

How to Verify ITR using Bank A/c Number- For this purpose, you need to follow the below steps.

Step 1- Go to the e-filing portal.

Step 2- Pre validate your Bank Account Number (if not validated yet)

Step 3- Click on the “My Account” Tab and Select “e-verify” from the drop-down.

Step 4- Select the “e-verify” link just after the respective assessment year.

Step 5- Select Generate EVC through Bank Account Number.

Step 6- Use this EVC to E-verify return.Now ITR Verification Completed Successfully.

-

Is a ITR verification compulsory?

After filing of Income Tax Return it is mandatory to verify your Income Tax Return (ITR), if you do not do so in a given time, then your return can be marked as invalid by the department.

In other words, the process of filing ITR is not just limited to submitting your return, but it involves some more steps to get your Income Tax Return ready. The process of this is as follows-

Step 1- E- File Your Income Tax Return.

Step 2- Verify your Income Tax Return.

Step 3- The income Tax Department process your return.

If all the above steps have been completed then it is assumed that the Income Tax Department has accepted your return.Considering the above ITR verification is compulsory.

Join our Social Community

Disclaimer: The information contained in the above article are solely for informational purpose after exercising due care. However, it does not constitute professional advice or a formal recommendation. The author does not own any responsibility for any loss or damage caused to any person, directly or indirectly, for any action taken on the basis of the above article.

Feedback/Suggestion- Hope you all find it useful, please give your valuable feedback & let us know if there is an error. Thanks in Advance

Compiled by- CA Chirag Agarwal (Practicing Chartered Accountants)