GST Registration is the first step for any business to be recognized under GST.

Businesses should apply for registration with proper documents in place. These vary depending on the type of business that you are trying to register.

The government has mandated GST Registration for all eligible businesses and failing in doing so may attract further tax-related implications which may cause your business to take a hit.

Who should register Under GST?

Following entities are eligible to be registered under Goods and Services Tax.

| Individuals practicing business in the previous tax system (VAT, Excise, Service Tax, etc.) |

| E-Commerce Aggregator |

| A supplier who supplies through an e-commerce aggregator |

| Businesses whose turnover exceeds above the threshold limit of Rs. 40 Lakhs (Rs. 10 Lakhs for special category states) |

| Agents of a supplier & Input service distributor |

| Taxpayers under Reverse Charge Mechanism |

Documents required for GST Registration

The documents required for successful GST Registration vary according to the type of business.

We can categorize the types of businesses as follows:

- Sole Proprietorship

- Partnership Business

- Pvt. Ltd. Company

- Limited Liability Partnership

Also Read: GSTR 3B Return- A Simple guide to GSTR 3B

Let’s understand GST registration documents as per business category.

Basic Documents common for all business types–

| Business Owner’s Documents | Business Documents |

| PAN Card | Bank Statement or Passbook of the business account |

| Aadhar Card | Business Address proof |

| Photographs | Registration Certificates, MOA or AOA |

Documents Required for Sole Proprietorship Business

| Business Owner’s Documents | Business Documents |

| PAN Card | Bank Statement or Passbook of the business account |

| Aadhar Card | Rent Agreement |

| Photographs | Ownership proof (electricity bill, phone bill, water bill) |

| Any other Government ID Proof |

Documents Required for Normal Partnership Business

| Business Owner’s Documents | Business Documents |

| PAN Card of the Partnership | Bank Statement or Passbook of the business account |

| Bank statement copy | Rent Agreement |

| Partnership Deed | Ownership proof (electricity bill, phone bill, water bill) |

| Letter for Appointment of Authorized signatory | |

| Declaration of Compliance | |

| Pan card & Identity proof of Individual Partners |

Documents Required for Pvt. Ltd. Business

| Company’s Documents | Office Documents |

| Registration certificate of the company | NOC of the owner |

| Pan card of the company | Rent Agreement (if required) |

| Memorandum of Association (MOA) | Ownership proof (electricity bill, phone bill, water bill) |

| Articles of Association (AOA) | |

| Copy of Bank statement | |

| Copy of Board resolution | |

| Letter for Appointment of Authorized signatory | |

| Declaration of Compliance |

Also Read: List of Documents required for New PAN Card application

Directors’ Documents:

- PAN Card & Aadhar Card of Directors

- Other ID proofs of the directors

- Photos

Documents Required for Limited Liability Partnership

| Company’s Documents | Office Documents |

| Registration certificate of the LLP | NOC of the owner |

| Pan card of the LLP | Rent Agreement (if required) |

| LLP partnership agreement | Ownership proof (electricity bill, phone bill, water bill) |

| Copy of Bank statement of the LLP | |

| Copy of Board resolution | |

| Letter for Appointment of Authorized signatory | |

| Declaration of Compliance |

Documents of the Partners:

- PAN Card & Aadhar Card of Directors

- Other ID proofs of the directors

- Photos

What is the GST Registration Limit?

Defining the GST Registration is one of the steps taken by the Government & GST Council to clear the air on the confusion of the GST Registration eligibility to register under GST.

GST Registration threshold is defined based on the category of state.

For Sale of Goods

| State Type | Aggregate Turnover | GST Registration |

| Normal Category State | 40 Lakhs and above | Required |

| Special Category State | 20 Lakhs and above | Required |

For Services

| State Type | Aggregate Turnover | GST Registration |

| Normal Category State | 20 Lakhs and above | Required |

| Special Category State | 10 Lakhs and above | Required |

Which states fall under Special Category?

- Arunachal Pradesh

- Assam

- Manipur

- Meghalaya

- Mizoram

- Jammu & Kashmir (Now a Union Territory)

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

- Uttarakhand

Rest all other states fall under the ‘ Normal category’.

Also Read: GSTR 1 Return- A Simple guide to GSTR 1

How to Calculate Aggregate Turnover for GST Registration?

It becomes very important to know if the business is eligible for the GST registration process or not based on the turnover. For this purpose, it is very important to define the term ‘Aggregate Turnover’.

It is mandatory for a business whose aggregate turnover in a financial year is above Rs 20 lakhs, to register under Goods and Service Tax. The same limit reduced to Rs 10 Lakhs for special category states and UTs. (For providing Services).

Understanding what is Aggregate Turnover in GST?

Aggregate Turnover is defined as the aggregate value of all the supplies on which tax is collected (excluding the value of inward supplies on which tax is payable by a person on a reverse charge basis), exempt supplies, exports of goods or services or both, and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax, and cess.’

Following are the details Included in the GST Turnover–

| Taxable Supply made to a distinct person having the same Permanent Account Number (Table 3.1(a) of GSTR-3B) |

| Non-GST Supply (Table 3.1(e) of GSTR-3B) |

| Zero Rated Supply (Table 3.1(b) of GSTR-3B) |

| Nil Rated Supply and exempted supply (Table 3.1(c) of GSTR-3B) |

| Taxes other than GST. |

| Value of outward supplies of goods and services on which the recipient is pays tax under RCM. |

| Goods received/Supplied from/to job worker on principal to principal basis. |

Following are the details Excluded in the GST Turnover–

- Value of inward supplies of goods and services on which the recipient is required to pay tax under reverse charge mechanism (Table 3.1(d) of GSTR-3B)

- Amount of central tax, state tax, union territory tax, and integrated tax and compensation cess

- Goods supplied for job work or received back after job work under section 143 of CGST Act, 2017

- Transactions which are neither supply of goods nor services i.e. Schedule III of CGST Act, 2017 as amended by CGST (Amendment) Act, 2018

If these details are being heavy to understand, let us try to understand the Aggregate Turnover with the help of an example.

Illustration:

There’s a company in Gujarat (Normal Category State) named ‘Amitbhai Milk Processors’. This company works to processes milk & makes it pasteurized & toned and supplies it to different parts of the country. This activity creates a turnover of about 2 Crore annually. This amount is exempted from GST.

Now along with milk processing, the firm also produces plastic cartons to store & supply the processed milk. The annual turnover gained from this activity is 26 Lakhs. The sale of plastic products falls under GST, & hence, this amount will be taxable under GST.

In simple words, the taxable amount of Amitbhai Milk Processor will be only Rs 26 Lakhs.

But the aggregate turnover will be 2 Crore + 26 Lakhs = 2.26 Crore and this firm will be eligible for registration under GST as it has crossed the threshold of 40 Lakhs. (For Normal Category State).

Must Read- Know the Difference between GSTR 1 and GSTR 3B

How to Download GST Registration Certificate?

GST Registration Certificate is a valid legal document that proves you are a valid entity registered under the GST on the GST portal.

It is advisable for all the businesses registered under GST to get a copy of their GST registration certificate downloaded as valid proof & explicitly display it at the place of your business.

Follow these simple steps to download your GST certificate.

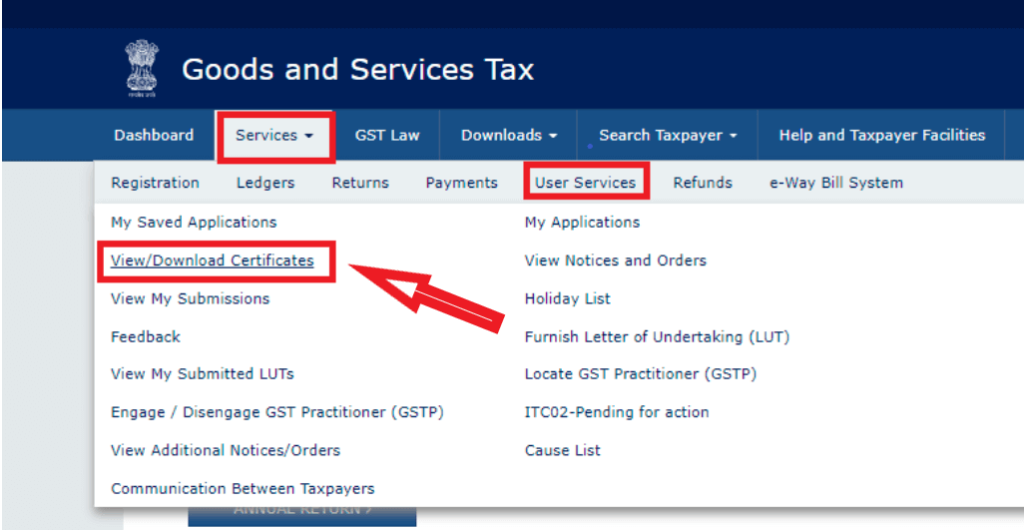

Step 1:

Log in to www.gst.gov.in

Step 2:

Click on ’Services’ > ‘User Services’ > ‘View/ Download Certificate.

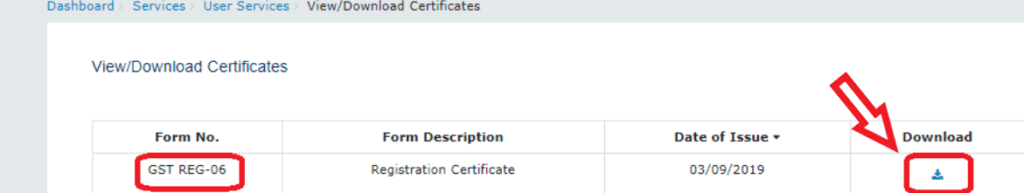

Step 3:

Click on the ‘Download’ icon on the next page.

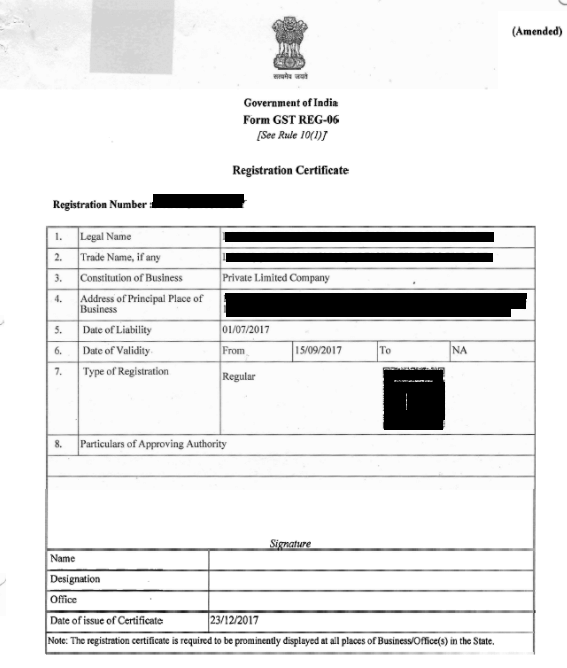

The downloaded Certificate will be similar as follows:

Details in the GST Certificate

- GST Identification Number of the registered entity

- Trade Name and Legal Name

- Type of Business Constitution (Eg: Partnership, Company, Proprietorship, Trust, etc.)

- Address of the Principal Place of Business

- Date of Liability

- Period of Validity

- Type of registration

- Particulars of the Approving authority- Name, designation, Jurisdictional office, and Signature (usually digitally signed).

How to Cancel GST Registration?

There can be multiple reasons for which your GST Registration may get canceled. Be it non-compliance with the rules or issues with the filing of your returns.

When you cancel your GST registration you will not be able to pay or collect GST. You’ll simply not be a member under GST

Who are eligible to cancel the GST Registration?

Following group of users can request GST Registration Cancellation.

- Tax Payer

- Tax officers

- Legal Heir of the Taxpayer

Request of Cancellation by a Registered Taxpayer

Whatever may be the reason for the cancellation, the procedure to do so is important. Let us understand the first type in detail.

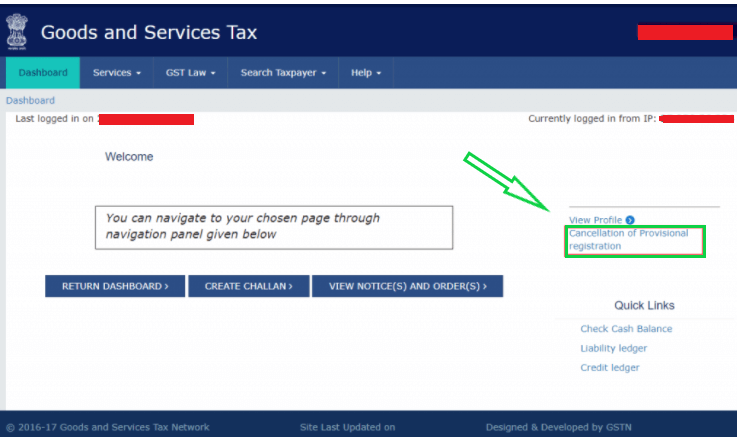

Step 1:

Log in to the GST Portal using your Username and Password.

Step 2:

Click on the ‘Cancellation of Provisional Registration’ tab a shown in the picture below.

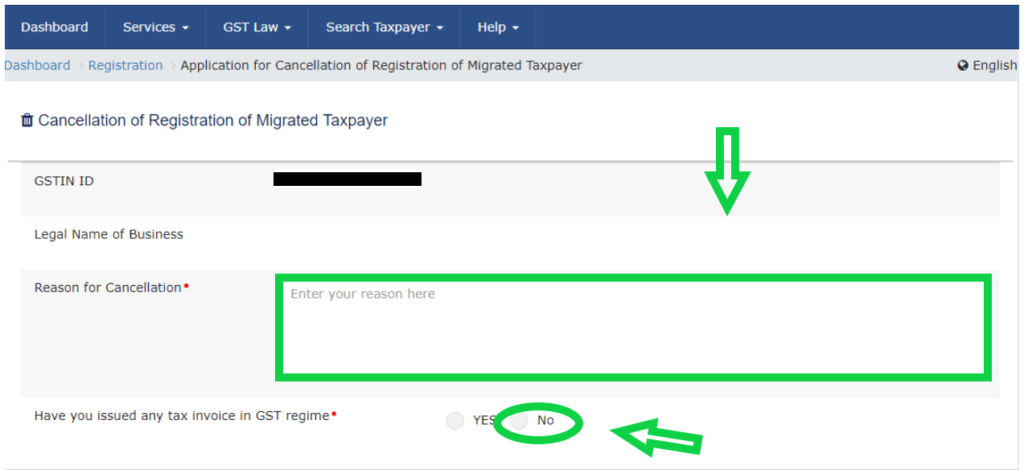

Step 3:

You’ll now see a page that will describe the reason for the cancellation. You’ll also be asked, “If you have raised any tax invoice in the period of GST.”

Select ‘No’.

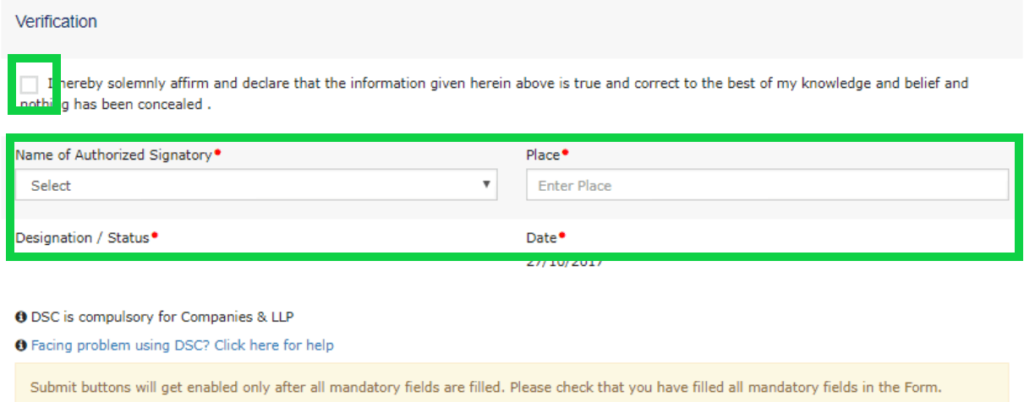

Step 4:

In this step, you shall provide the details of the authorized signatories.

The taxpayer will now be verified based on the information furnished by him. He has to submit all the form-related details along with the Digital Signature or Electronic Verification Code.

You’ll be required to sign the document with:

- Electronic Verification Code (EVC) – For businesses registered as a ‘Partnership’ or ‘Proprietorship’.

- Digital Signature Certificate (DSC) – For Limited Liability Partnerships (LLPs) and Companies.

NOTE: The steps mentioned above apply to only those taxpayers who have NOT issued tax invoices.

If the taxpayer has already issued any tax invoice then he is required to file FORM GST REG-16.

Request of Cancellation of GST Registration by a Tax Officer

GST registration cancellation requests can also be issued by an authorized tax officer. If the taxpayer fails to comply with the GST Rules 7 is found violating them then Tax Officer can intervene in such a case and proceed with the cancellation procedure.

Possible Reasons for such request:

- If the taxpayer violates the anti-profiteering provisions (for example, not passing on the benefit of Input Tax Credit to customers)

- Conduct of business from some other place than the one which is declared as primary.

- Violation of Rule 86-B

- If the taxpayer is availing input tax credit in violation of the provisions of section 16 of the CGST Rules, 2017 and CGST Act, 2017.

Procedure to be followed by a Tax Officer to Invoke GST Registration Cancellation

- Issue a show-cause notice to the concerned person in FORM GST REG-17

- The concerned person is expected to respond within 7 days through FORM REG–18 stating the reasons that why his registration should not be cancelled

- If the Tax Officer finds the response to be valid and satisfactory, he will cancel the termination request and respond as an order through FORM REG-20.

- If the registration is liable to be cancelled, the tax authority will issue an order in FORM GST REG-19. The order will be sent within 30 days from the date of reply to the show cause.

Important Forms for GST Registration Cancellation

| Form | Details |

| GST REG 16 | Applicable only when the taxpayer himself applies for the cancellation of his GST registration. |

| GST REG 17 | To give a show-cause notice or cancellation notice to the taxpayer or his business entities. |

| GST REG 18 | The show-cause notice can be replied to by the means of furnished GST REG 18 form under the specified period stated in the sub-rule (1). The taxpayer or the concerned party must reply to the notice within 7 days of issuance of the notice explaining safeguarding the cancellation of registration. |

| GST REG 19 | This form is used by the GST officer for passing an order for the cancellation of GST registration. The order for sending the notice must be under 30 days from the date of application or the response date in GST REG 18 form. |

| GST REG 20 | If the GST officer is satisfied with the reply to the show-cause notice, can direct for the revoke of any proceedings towards the cancellation of the registration and he should pass the order in the Form GST REG 20. |

Revocation of Cancellation under GST

If cancellation is upon you imposed by an authorized officer, you can apply for revocation of cancellation within 30 days from the date of the cancellation order.

The process is as described below:

- You can apply for revocation of cancellation through FORM GST REG-21 on the GST portal.

- If the authorized officer is satisfied with the reason you provide, the registered office is required to follow the procedure stated below:

1. Submit the reasons for the revocation of cancellation of registration in writing.

2. Reverse the cancellation of registration.

3. Pass an order to revoke the cancellation procedure through FORM GST REG-22.

- If the tax official finds the reason to be unsatisfactory, he can reject the application for revocation. The authorized tax official is required to pass an order via FORM GST REG–05 and communicate the same.

- Before rejecting, the proper officer must issue a show-cause notice in FORM GST REG–23 for you to show why the application should not be rejected.

- The taxpayer must reply in FORM GST REG-24 within 7 working days from the date of the service of the notice.

- The proper officer is expected to take a decission within 30 days from the date of receipt of clarification in FORM GST REG-24.

Who Cannot File the Cancellation Request for GST Registration?

- Taxpayers registered as Tax Collectors/deductors

- Taxpayers who are assigned Unique Identification Number (UIN)

GST Registration Fees

The government of India does not charge you any fees for the GST Registration process.

If the individual taxpayers choose to take services from any professional service providers, then they may be charged accordingly.

Until the next time…

Compiled by- GSTHero– Making GST Simple!

GSTHero is the best GST filing, e-Way Bill Generation & E-Invoicing Software in India. GSTHero is a government-authorized GST Suvidha Provider. Both Businesses and Tax Practitioners can file GSTR 1, GSTR 3B, GSTR 9, and GSTR 9C with all supporting reports. 1 Click Auto Reconciliation & report-matching feature helps you in claiming up to 100% ITC and finds your GST Defaulting Suppliers. GSTR2A vs GSTR-3B, GSTR-1 vs GSTR-3B, ‘GSTR-1, GSTR-2A & GSTR-3B’ annual report matching is also provided by GSTHero.

GSTHero ERP Plugins provide 1 Click e-Way Bill & E-Invoice, Generation, Operation & Printing from your ERP like Tally, SAP, Marg, Busy, Microsoft Dynamics, Oracle & others itself with high data security

Frequently Asked Questions (FAQs)

-

Who is eligible for GST registration?

Following entities are eligible to be registered under Goods and Services Tax.

– Individuals practicing business in the previous tax system (VAT, Excise, Service Tax, etc.)

– E-Commerce Aggregator

– A supplier who supplies through an e-commerce aggregator

– Businesses whose turnover exceeds above the threshold limit of Rs. 40 Lakhs (Rs. 10 Lakhs for special category states)

– Agents of a supplier & Input service distributor

– Taxpayers under Reverse Charge Mechanism -

IS GST Registration Free?

The government of India does not charge you any fees for the GST Registration process. If the individual taxpayers choose to take services from any professional service providers, then they may be charged accordingly.

-

How do I cancel my GST Registration?

Step 1:- Log in to the GST Portal using your Username and Password.

Step 2:– Click on the ‘Cancellation of Provisional Registration’ tab shown in the picture below.

Step 3:- You’ll now see a page that will describe the reason for the cancellation. You’ll also be asked, “If you have raised any tax invoice in the period of GST.” Select ‘No’.

Step 4:- In this step, you shall provide the details of the authorized signatories.

The taxpayer will now be verified based on the information furnished by him. He has to submit all the form-related details along with the Digital Signature or Electronic Verification Code.

NOTE: The steps mentioned above apply to only those taxpayers who have NOT issued tax invoices.

If the taxpayer has already issued any tax invoice then he is required to file FORM GST REG-16. -

What does it cost to register for GST?

The government of India does not charge you any fees for the GST Registration process. If the individual taxpayers choose to take services from any professional service providers, then they may be charged accordingly.

Join our Social Community

Disclaimer: The information contained in the above article are solely for informational purpose after exercising due care. However, it does not constitute professional advice or a formal recommendation. The author does not own any responsibility for any loss or damage caused to any person, directly or indirectly, for any action taken on the basis of the above article.

Feedback/Suggestion- Hope you all find it useful, please give your valuable feedback & let us know if there is an error. Thanks in Advance